- New

Verge HealthTech Fund- Creating Healthcare access through Technology

Healthcare access remains a critical challenge in low- and middle-income countries (LMICs), particularly in rural areas. A global venture capital fund based in Singapore, Verge HealthTech Fund1 addresses rural access disparities by investing in technologies that improve healthcare affordability, accessibility, and efficiency where traditional healthcare infrastructure is limited or absent. Their investment in the startup reach52, focused on bridging this gap in LMICs, demonstrates how strategic capital allocation can drive both social impact and commercial success in global health.

Bridging the Innovation Funding Gap in Underserved Markets

Founded in 2018, Verge is an early-stage impact fund focused on the unique intersection of global health and innovation. Driven by the belief that access to quality healthcare is a fundamental human right, the fund specializes in identifying and supporting scalable technologies that can solve large unmet health needs, particularly in emerging markets where traditional healthcare infrastructure is limited. The fund focuses exclusively on impactful healthtech startups at their earliest stages, when capital is typically most challenging to secure due to the higher risk profile of new technologies.

Verge goes beyond capital investment, actively supporting portfolio companies with subject matter expertise, connections, and critical resources for early-stage development. The fund facilitates portfolio collaboration on R&D, commercial distribution, and clinical trials. This comprehensive approach has proven effective: started in 2018, Verge's first fund's portfolio has to date impacted 22 million lives from a fund size of just over US $7.5 million, with 98% of beneficiaries in LMICs. Named after the stark statistic that over 52% of the world cannot access essential healthcare, Verge's portfolio company reach52 stands as an example of their investment thesis.

The investment in reach52: Delivering Health Services in Markets Others don't Reach

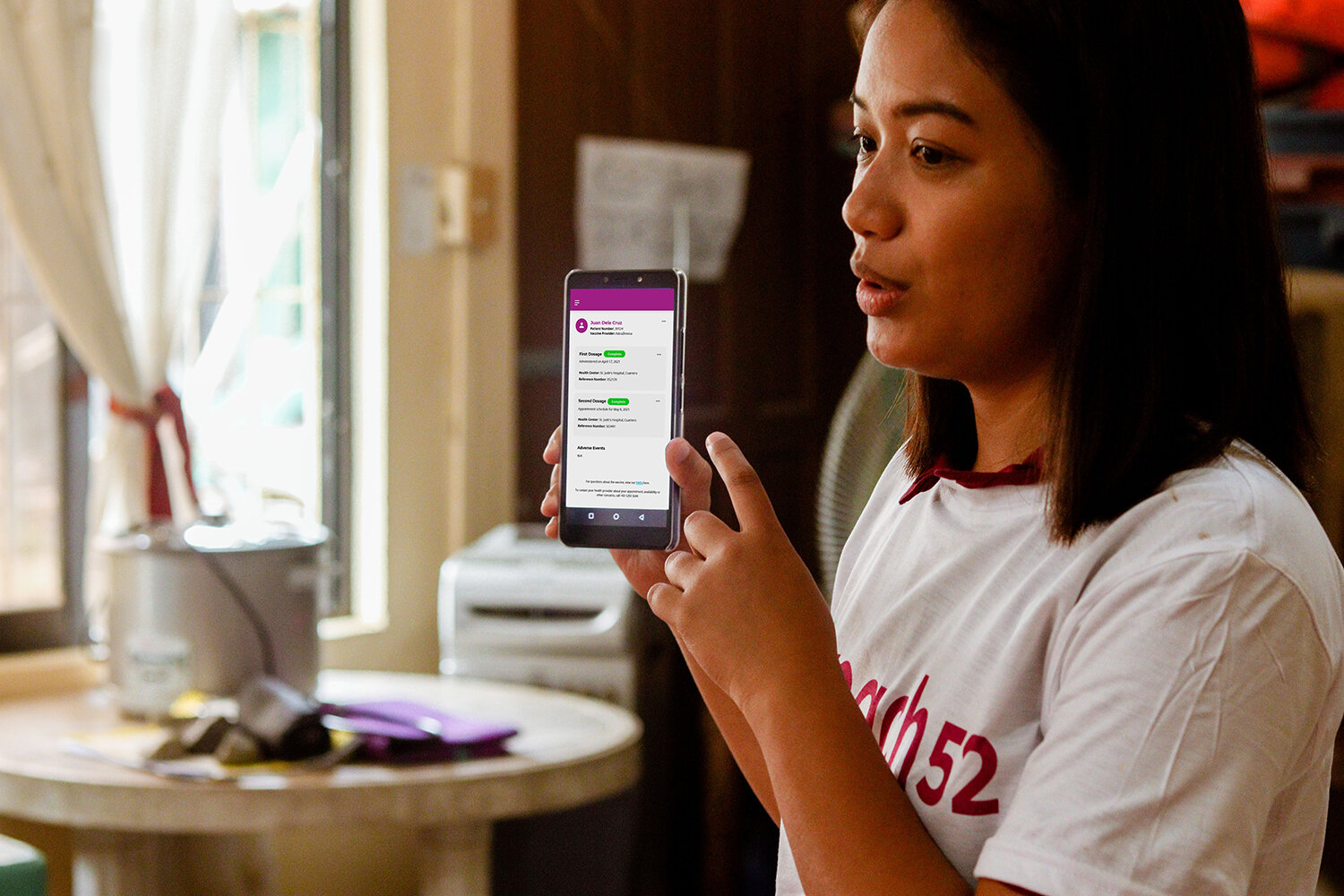

reach522 has developed a tech-enabled platform that connects rural communities with healthcare workers, pharmacies, and primary health centers through a two-pronged approach.

First, they train Community Health Workers (CHWs) to gather data about community health needs and product availability by conducting household surveys. This data collected enables partners to develop targeted health campaigns that promote health-seeking behaviors fully backed by relevant local insights.

Second, reach52 strengthens the local healthcare ecosystem by establishing referral pathways between communities and primary health centers, covering over 15 health areas including diabetes, dengue, mental health, and vaccines. The company also expands access to affordable healthcare products by working with local pharmacies and stores to supplement government-provided supplies, ensuring communities can purchase essential medical products locally.3

From Start-up to Scale: reach52's Journey to Impact Millions

Thanks to Verge's investment, reach52 has transformed from a 20-person team into a company of over 50 members generating substantial revenue. This growth has made reach52 an attractive investment opportunity not only for impact investors but also for traditional investors who prioritize financial returns.

Since Verge's initial investment, reach52 has achieved remarkable milestones across several areas of healthcare delivery including expanding from Asia into Africa, launching their pharma distribution business arm, and building out their global leadership team. The organization's strategic expansion now spans seven countries across Asia and Africa - the Philippines, Cambodia, Indonesia, India, Myanmar, Kenya, and South Africa. Their platform has grown to include nearly 40 affordable, high-quality generic treatments, reaching underserved populations through an extensive network of 72,000 pharmacies in rural and lower-tier regions. From 2016 to 2023, reach52 successfully onboarded and trained 16,500 CHWs across 2,500 communities, creating jobs, improving incomes, and building healthcare delivery capacity.

Collectively, reach52 initiatives have positively impacted an estimated 1.8 million people. In particular, the following health outcomes have been measured:

- 78% vaccination rate achieved among previously unvaccinated individuals

- 70% attendance rate for prenatal care visits by pregnant mothers engaged through reach52

- 65% improvement in blood pressure control among patients within three months of engagement

- 98% adherence rate to treatment protocols in the diabetes support program

Lessons Learned and Vision for the Future

Verge's experience with reach52 has demonstrated that rural healthcare businesses can be commercially sustainable with an adaptable approach to lower the business and financial risks often encountered by early-stage startups. To that end, the multi-layered approach used by reach52 was crucial, explains the founder of Verge, Dr. Joseph Mocanu: "The key was to have a variety of business models that could facilitate company growth at different levels of maturity. For example, in the early stages, pharmaceutical CSR initiatives and primary research campaigns can plant the seeds for the business, enabling the accumulation of a population covered by community health workers. Once a sufficient number of lives are covered, the company can generate revenue through direct-to-consumer (D2C) sales of products and services, as well as from the data produced. Initiatives that rely on a single business model tend to fail, especially those that do not engage with multinational corporations early enough."

While scaling global health projects presents unique challenges, Verge leverages their position as first investor to build the initiative for success and pave the way for additional capital by creating confidence around each project. While due diligence for investments in early-stage companies in LMICs can face obstacles in terms of capabilities and resources, Verge demonstrated their adaptability from the very beginning of the project, making use of solutions such as virtual visits to evaluate remote locations. Their pioneering participation ultimately helped secure further funding from a major healthcare strategic investor, validating both reach52's approach and Verge's investment strategy.

Verge maintains an active but non-executive role, participating on the Board while facilitating crucial connections with potential customers, distribution partners, and future investors. Through ongoing activities like case study sharing, conference presentations, and ecosystem engagement, the fund continues to strengthen reach52's network and market presence. As the company grows and welcomes new investors, Verge's role may evolve, but their focus remains unchanged: creating sustainable pathways for growth while maintaining healthcare delivery quality. Looking ahead, Verge is focused on applying lessons learned from its reach52 investment across different markets, not through direct replication, but by adapting their proven strategies to local contexts where similar approaches could create meaningful impact.

1Verge HealthTech Fund: https://www.verge.fund/

2reach52: https://www.reach52.com/

3World Economic Forum: https://initiatives.weforum.org/global-health-equity-network/case-study-details/reach52/aJY68000000oLlDGAU