- New

The Health Finance Coalition & Open Doors Africa Private Healthcare Initiative - Bringing stability to at-risk healthcare providers

Health Finance Coalition (HFC), a group of leading health donors, investors, and technical partners seeking to scale blended finance solutions to achieve SDG3 and Universal Health Coverage in Africa, created The Open Doors African Private Healthcare Initiative (ODAPHI). It is one of the first loan guarantee facilities of its kind, working to make working capital loans available to frontline healthcare facilities in five African countries during the COVID-19 pandemic and early-post pandemic period.

Blended Finance: Sustaining Essential Healthcare during Crisis

In sub-Saharan Africa, private sector healthcare providers deliver nearly 50 percent of all healthcare1, including life-saving interventions such as early malaria diagnosis and treatment, ante-natal care, and routine vaccinations. Given this crucial role, economic instability in the private healthcare sector can significantly impact the provision of essential health services across the region.

As such, the COVID-19 pandemic created unprecedented challenges for these providers. Associated economic shutdowns and stay-at-home policies led to declining service demand and revenue, particularly in the private sector. This downturn threatened operational viability at a time when healthcare accessibility was already strained. Many SME healthcare facilities that typically maintained adequate cash flow to meet standard credit underwriting criteria found themselves financially constrained due to the pandemic's impact.

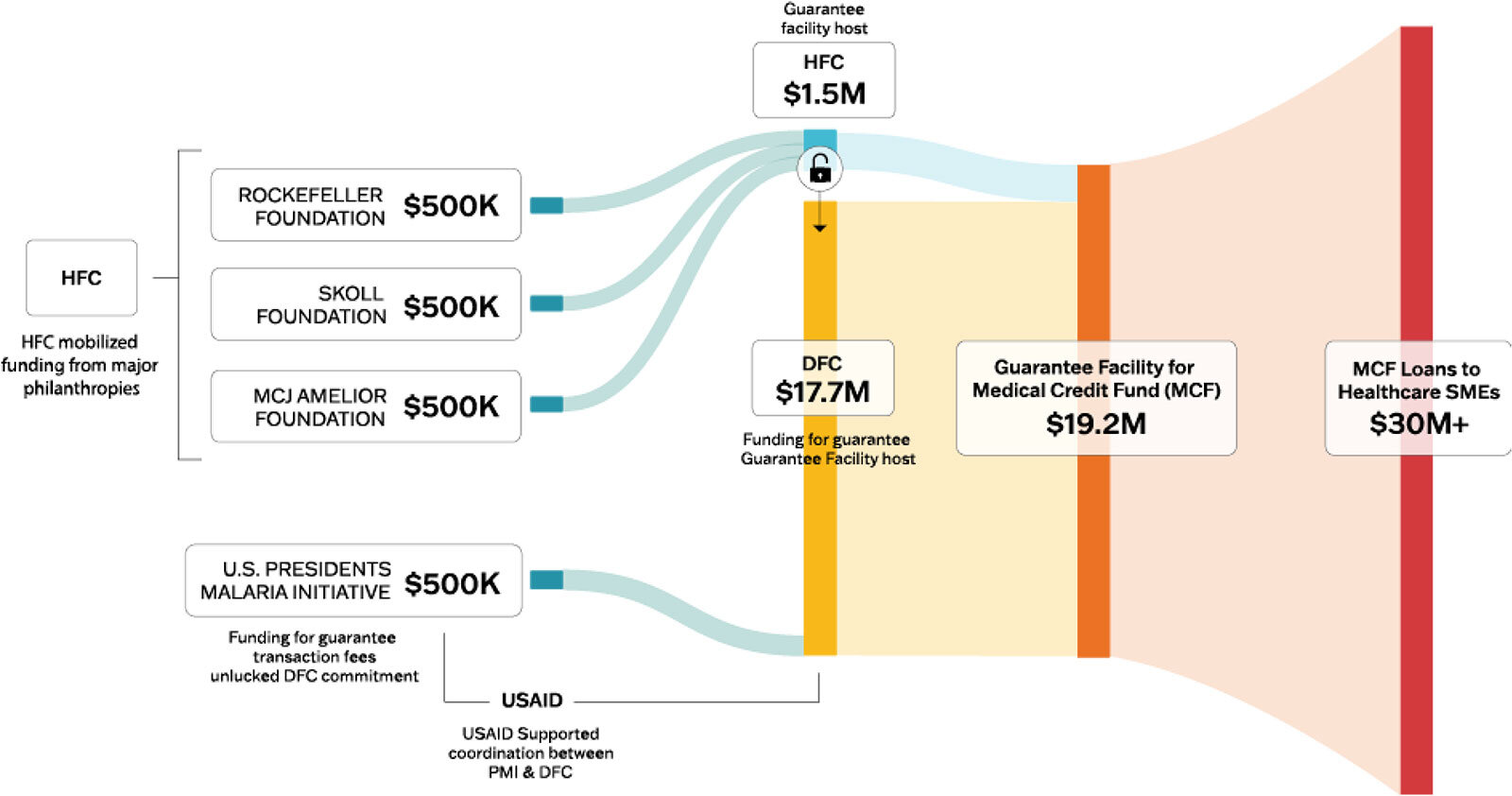

In response, HFC designed the ODAPHI program to provide guarantees to support urgent working capital needs of SME healthcare facilities, enabling them to continue essential healthcare operations during the pandemic. Emphasizing the essential role of these SMEs, HFC played a pivotal role in creating the dual guarantee facility and rallying partners. The program operates through two guarantee structures: a private sector-led guarantee funded by the Skoll Foundation, Rockefeller Foundation, and MCJ Amelior Foundation and administered by HFC, and guarantee funded by the U.S. President's Malaria Initiative (PMI) and the U.S. Development Finance Corporation (DFC) and administered by DFC. Establishing itself as a crucial facilitator in the healthcare investment landscape, HFC notably brought together the DFC and USAID to collaborate on an investment for the first time.

<ODAPHI's blended finance guarantee structure>

Through those two structures, 19.2 million USD in guaranteed capital was secured, allowing to loan up to 30 million USD through Medical Credit Fund (MCF) - the only fund dedicated to financing SME healthcare enterprises in Africa. The ODAPHI facility ensures that the donors-funded guarantee will cover between 50 and 80 percent of loan principal, should borrowers default. "While many banks halted credit lines during COVID-19, MCF could continue to provide credit because the guarantees insured against losses and allowed MCF to abide by its covenants," described the HFC team.

The program's success also hinged on its phased implementation structure allowed by the participation of diverse partners, as the initial USD 1.5 million guarantee secured from private actors served as a crucial bridge until the larger PMI/DFC guarantee could be finalized later on. This strategic approach enabled MCF to begin loan disbursements to SMEs faster. With the addition of the DFC managed guarantee, MCF was able to access significantly larger amounts of guarantee, scaling the amount of loan capital that could be disbursed from USD 3 million to USD 30 million.

Reaching the Underserved: An Impact spanning Multiple Countries

Since January 2021, the program has achieved significant reach and impact. 8 companies received loans supporting over 267 healthcare facilities across Ghana, Kenya, Nigeria, Uganda, and Tanzania. Overall, these facilities serve approximately 170,000 patient visits per month, totaling 2,040,000 visits annually.

HCF notes that patients come to MCF-funded clinics principally for mother, new-born and child healthcare needs, as well as fever, malaria, and respiratory tract infections treatment, which allowed ODAPHI-funded facilities to reach under-served populations. Of all patients, 58% are women and 11% are children; 42% are classified as low income and 19% are classified as very low income. This performance either meets or exceeds the targets set at the start of the ODAPHI program for each target demographic group.

A Blueprint for Healthcare Investment

ODAPHI's success now serves as proof of HFC's effective approach to healthcare investment in Africa. "Given the initial success that the ODAPHI guarantee portfolio has experienced, we see this as a strong demonstration of the HFC's capital stack approach for investment in African healthcare systems," notes Alex Honjiyo, Deputy Director of HFC. "We see increasing opportunities to highlight this success and promote the ODAPHI guarantee facility as a case study of how blended finance approaches can work to mobilize healthcare investment in Africa." For HFC, ODAPHI's performance has directly catalyzed the development of additional work, including the development of two funds (Transform Health Fund, Outcomes Fund for Fevers) and of a Deal Construction Platform.

The program's effectiveness has also led to recognition beyond HFC, with DFC and USAID frequently inviting presentations to both internal staff and external partners, establishing ODAPHI as a blueprint for future healthcare investment initiatives. As ODAPHI model's strength lies in its replicability, it can support larger-scale lending throughout the healthcare sector. This approach has already been effectively employed by impact investors and various development finance institutions (DFIs) to mobilize investment capital into key healthcare sectors - including SIDA and DFC - such as the SDG Outcomes Fund in Africa and South Asia.

1https://givingcompass.org/article/why-fund-private-healthcare-providers-in-africa