- New

LeapFrog Investments - Advancing Impact Measurement in Health

LeapFrog Investments, a pioneer in global impact investing, observed that impact measurement for private healthcare investments remains at a nascent state compared with similar tracking across public health systems. LeapFrog wanted to find more advanced metrics that deliver a deeper analysis of the comparative economic impact and health outcomes of various interventions, to drive greater investment in the areas with the most social benefit. When investors can better measure their impact, capital allocators can also make more informed choices as to where to deploy their funds. LeapFrog Investments tested the use of Disability-Adjusted Life Years (DALYs) and Social Return on Investment (SROI) with one of their portfolio companies, the fast-growing Indian diagnostics business Redcliffe Labs. Preliminary results suggest that these methods can translate well into private investments and are tools that can be used to estimate impact returns alongside financial returns.

LeapFrog's Vision of Impact Investing

Impact investing has traditionally focused on reach and volume metrics - such as the number of patients screened for a medical condition by a health provider, or the percentage of an organization's clients receiving effective healthcare in a specific time period - to offer an overall view of the health impact of an investment. Governments and major health programs have developed multiple social and economic value approaches that offer a superior understanding of the impacts of health investments, although have yet to be adopted by the investing community.

In particular, Disability-Adjusted Life Years (DALYs) and Quality-Adjusted Life Years (QALYs) have proven powerful tools in the assessment of health investments across multiple jurisdictions, including in Low- and Middle-Income Countries (LMICs)1. Additionally, the Social Return on Investment (SROI) methodology assigns financial value to the generated social impact and creates a common language to evaluate healthcare interventions.2

Working with PA Consulting, a global innovation and transformation consultancy, LeapFrog conducted a study on the impact of one portfolio company with two objectives: (1) to understand the practical application of impact metrics such as QALY/DALY within the dynamic landscape of impact investing, and (2) to quantify the social impact generated by their portfolio company.

Measuring DALYs at Redcliffe Labs

Redcliffe Labs is a digitally-enabled, affordable and convenient omni-channel diagnostics service operating across 220 towns with 80 labs and 2,000+ walk-in collection centers in India. It presents a social impact opportunity centered on illness prevention and wellness. The company primarily provides access to affordable, convenient diagnostic services with a focus on preventive care. This enables a reduction of non-communicable diseases by directing customers towards simple treatments that offer low-cost, long-term solutions to common NCDs. Redcliffe's pricing is around 25-60% lower than similar tests sold by incumbent players, while providing the convenience of home tests. However, the focus for Redcliffe is providing the most value for money, rather than offering the lowest prices.

The widely accepted DALY metric was used to calculate the health and economic impacts of Redcliffe's complex suite of diagnostic tests spanning multiple disease categories, as well as helping to develop comparative analysis between the cost of various private and public health interventions for the same diseases. One DALY is equal to the loss of one year of life in perfect health due to disease. DALYs can also be translated into an economic impact using an annual measure of per capita economic output, like percentage of GDP per capita - a methodology endorsed by the World Health Organization.

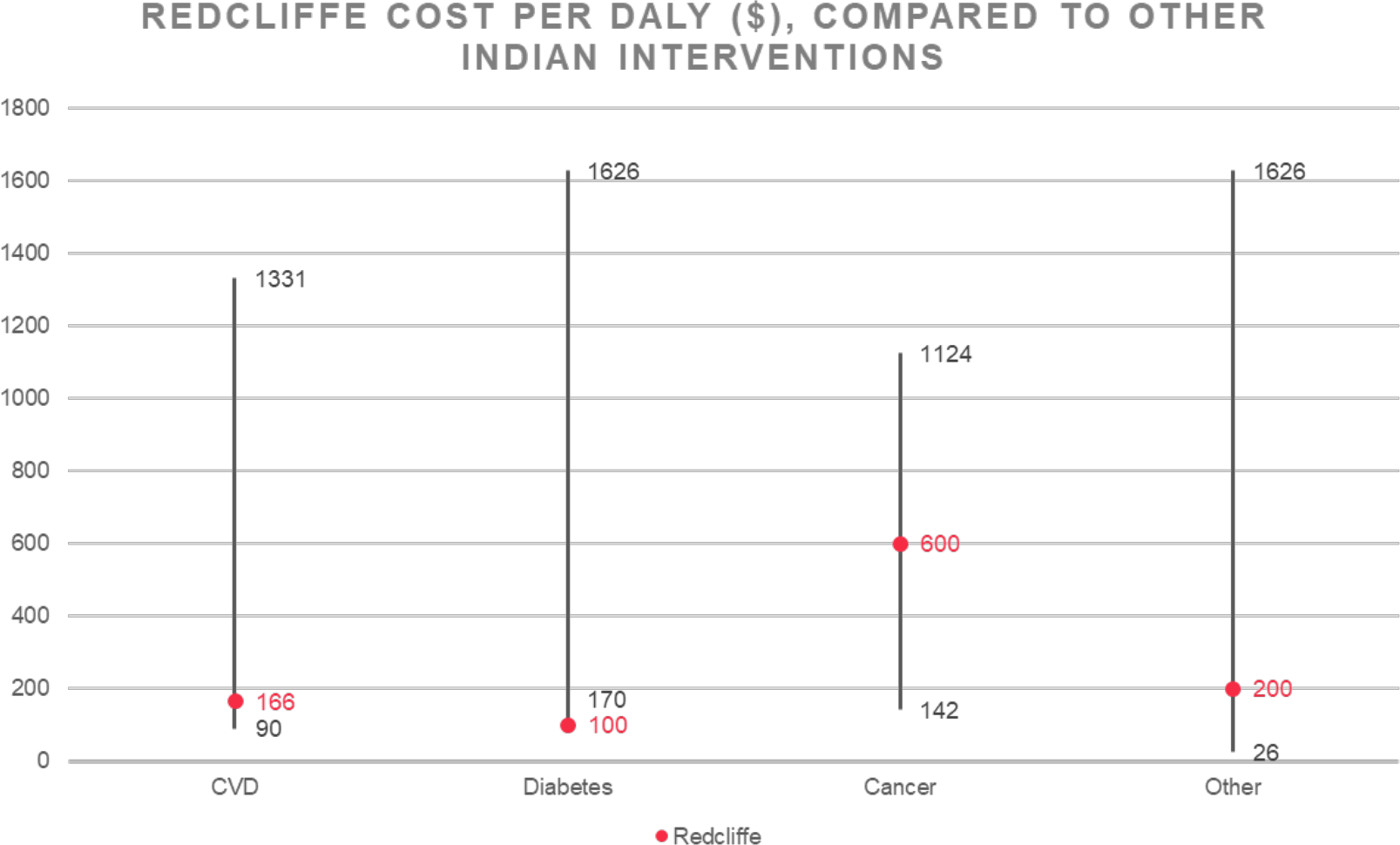

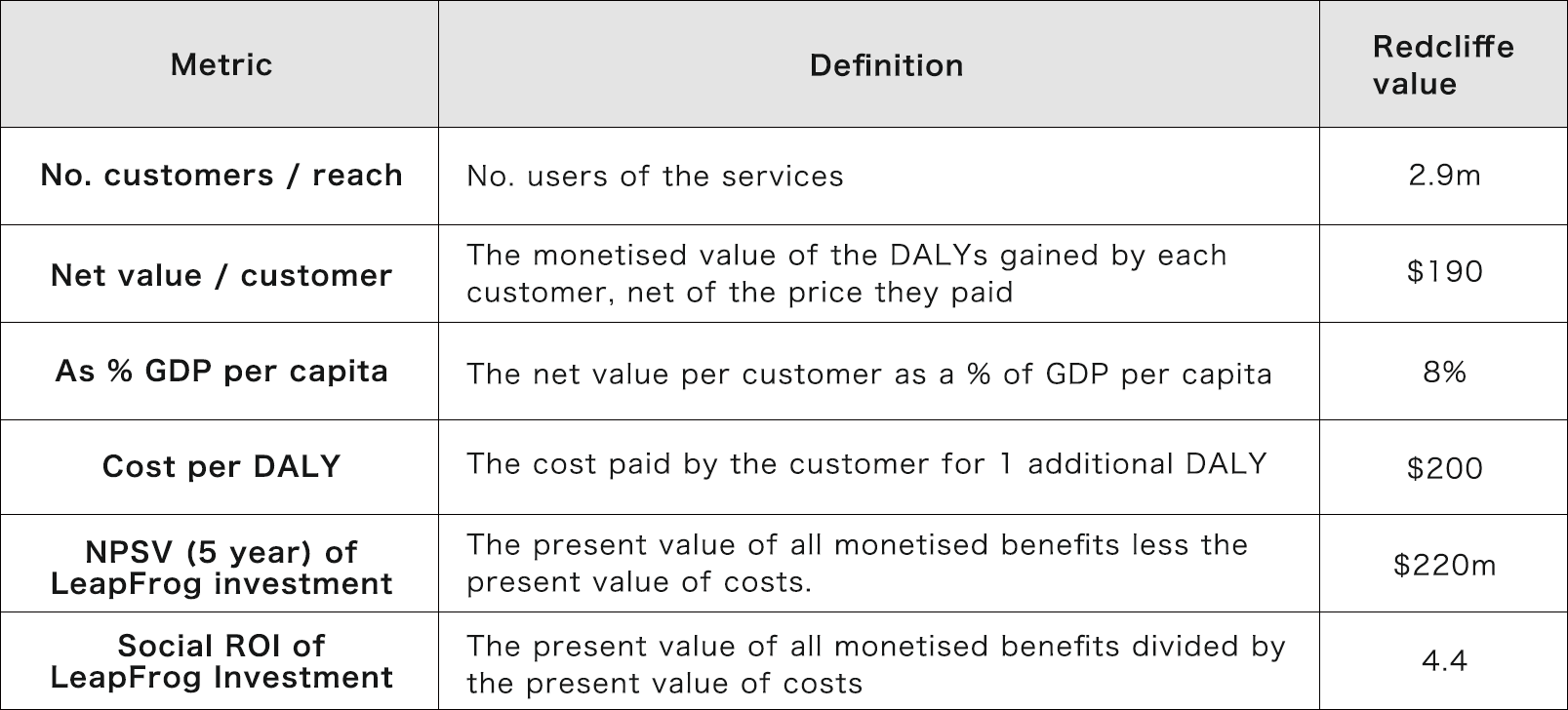

When the DALY analysis was combined with cost data, based on the price paid for the tests by the customer, Redcliffe Labs was highly cost-effective when compared with global benchmarks and thresholds. The average cost per DALY averted offered by Redcliffe is $200. This means that for the price of $200, Redcliffe Labs was able to avoid the loss of one year of healthy life. This compares favorably with thresholds calculated for LMICs of approximately $500. The comparative analysis substantiated that Redcliffe interventions often have high levels of cost effectiveness (<$1000/DALY) - with CVD and diabetes being $166 and $100, respectively. Redcliffe generated approximately 175,000 DALYs with an average of 0.09 DALYs per customer (for the first annual cohort of customers). They calculated these DALYs for six key disease areas: Cardiac Heart Disease (CHD), Diabetes, multiple Cancer types, and Liver, Kidney, Thyroid diseases. This demonstrates high levels of healthcare outcomes generated per dollar invested.

Combined with data on GDP per capita, LeapFrog also calculated a gain of $180 for every individual that purchases Redcliffe's services, net of the price paid by the customer. This produces an individual return on investment (ROI) of 10X. LeapFrog also used this data to compute the Social Return on Investment (SROI) for their involvement in Redcliffe. The estimated SROI value of 4.4 is considered an excellent return on investment within the public sector (>4).

Using these metrics, LeapFrog's equity share is estimated to have produced $220 million in gross economic value to the portfolio. DALYs are insightful for both the investor and the company, so the leadership can strategically amplify its influence by either increasing the uptake of tests in high-impact areas or focusing on enhancing treatments through value-added services.

Reflecting on the case of Redcliffe Labs, Dr.Biju Mohandas, partner and global co-leader for health investments at Leapfrogs Investments, emphasized the importance of measuring beyond conventional output metrics. "LeapFrog will go beyond output numbers, measuring outcomes like Disability Adjusted Life Years (DALYs) saved by our portfolio companies. By understanding the depth of our impact, we can align high social returns with top quintile financial performance. This empowers us to make investments that truly transform emerging consumers' lives, maximizing value in the most meaningful way."

Similarly, Dr. Sohini Sengupta, medical laboratory director at Redcliffe Labs reiterated the effect of having sophisticated metrics. "The importance of these sophisticated metrics is even greater in emerging markets like India where the growing burden of non-communicable diseases (NCD) is near epidemic proportions. Redcliffe Labs plays an important role in broadening the reach of high-quality diagnostics and driving innovations that lower costs and increase convenience. It's not just about how many patients you reach; it's about how profoundly you impact their lives and the broader community. By embracing complex but insightful metrics, impact investors can ensure they are genuinely making a difference."

LeapFrog Investments aspires to conduct similar studies for the relevant healthcare investments to better understand and manage the social impact across its portfolio companies (individually and cumulatively) and to allocate capital to maximize value from our investments.

LeapFrog's summary of metrics for Redcliffe Labs:

1For additional information on DALYs and QALYs, please refer to the WHO, available here.

2For additional information on SROI, please see the UNDP guide, available here.